Who buys carbon credits, and why?

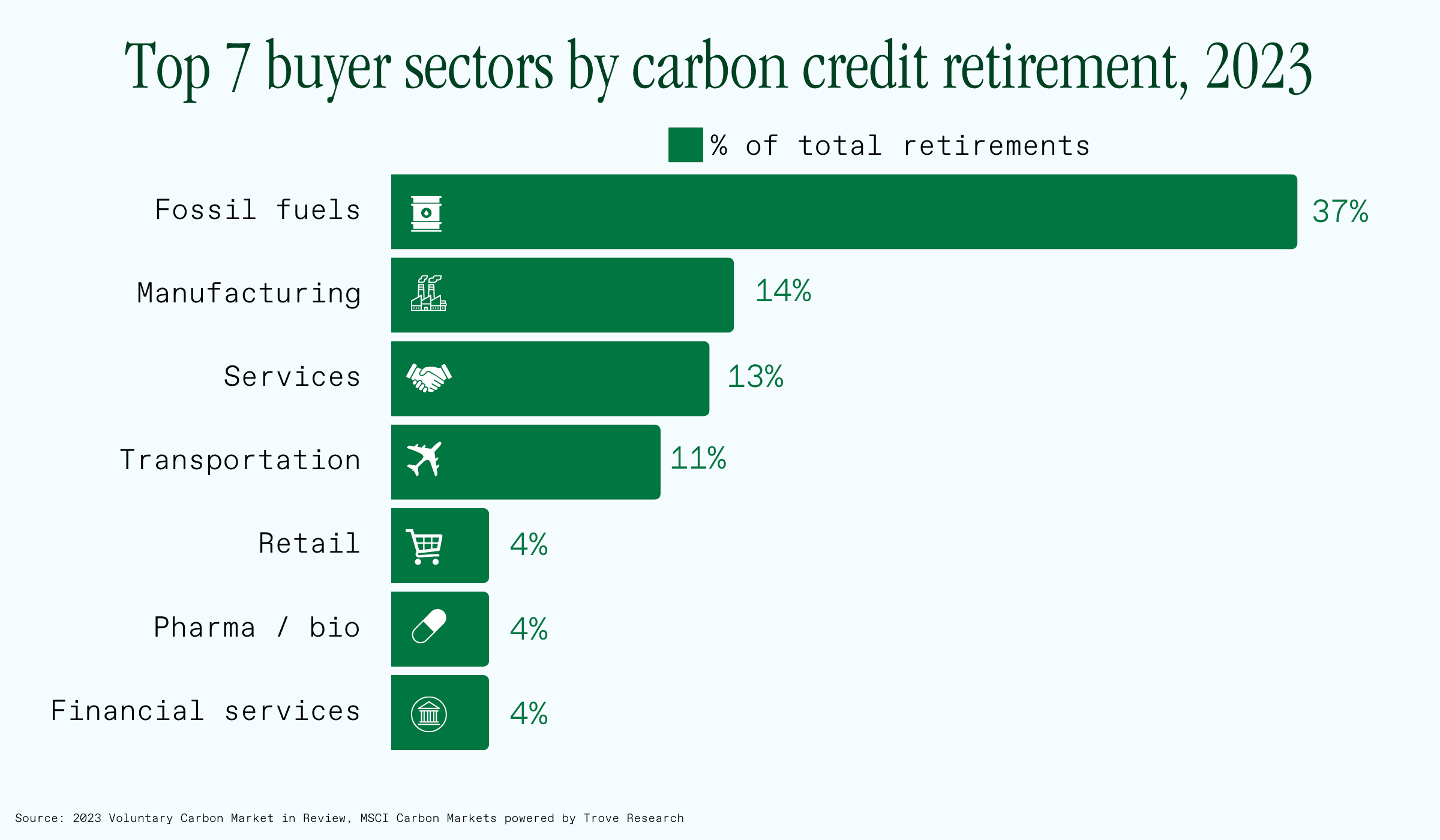

A total of 178 million carbon credits were retired in 2023. That’s roughly equivalent to the combined annual emissions of the Netherlands and Luxembourg. While not a huge impact, surely, it’s still, well, better than nothing.

For a refresher of what carbon credits are and how retirements work, see this article.

You may be wondering: who exactly is buying and retiring these credits? And what are their motivations?

Let’s dig in.

Who were the largest carbon credit buyers in 2023? Which sectors retire the most carbon credits?

Voluntary market carbon credits are tracked across four large and a variety of smaller registries (more about them here).

Thankfully, the job of adding up retirements across these sources has already been done by MSCI Carbon Markets (previously Trove Research) in their 2023 VCM overview report.

Perhaps unsurprisingly, the top industries for carbon credit retirements are roughly what you’d expect: fossil fuels, manufacturing, services and transportation.

The top 3 retirers in particular are a perfect cross-section:

- Dutch energy company Shell, with 16 million tonnes of credit retirements, the bulk of which are in forestry and nature restoration.

- German car manufacturer Volkswagen, with 8 million tonnes retired, half of which is related to renewable energy and half to nature restoration.

- Japanese pharma company Takeda, with nearly 3 million credits retired, mostly from mitigation of non-CO2 gases.

Why do companies buy carbon credits?

Since the pool of voluntary carbon credit buyers is quite broad, it’s hard to nail down one single motivation. However, we can draw some reasonable inferences by extrapolating from company reports and public statements.

Why might companies buy carbon credits? Let’s rank some potential reasons from least to most cynical:

- They truly believe in the importance of sustainability

- They want to mitigate the business risks of climate change

- They see sustainability as a competitive advantage

- They feel pressure from investors, employees, and other stakeholders to act in a climate-conscious way

- They want to take advantage of PR and marketing benefits

In short, the potential range of reasons is broad. In reality, it’s likely that for any individual company, the motivation is multifaceted and includes several of the factors outlined above.

As an example, let’s look at what Volkswagen, the 2nd largest credit retirer in 2023, says:

“With our sustainability concept we want to ensure that opportunities and risks associated with our environmental, social and governance activities are identified as early as possible at every stage of the value creation process.” - Volkswagen Group sustainability overview

It seems reasonable to assume that all buyers will continue to act according to a mix of incentives. But perhaps even more important than the “why” of carbon credit purchases is the impact. So let’s turn to see whether these companies behave differently than non-credit-buyers in other ways.

Are companies buying carbon credits to get out of doing any other meaningful sustainability activities?

It’s often assumed in the media that the most active participants in the voluntary carbon market are simply “buying indulgences” and not doing anything else meaningful. But when you dig into the data, the opposite trend emerges.

1. Voluntary credit buyers are 1.2x more likely to report their emissions and to have board level oversight of climate targets than non-buyers

Based on research by Ecosystem Marketplace, 97% of voluntary carbon credit buyers both have board oversight of climate-related issues, and 97% also disclose their emissions (compared to 82% and 81% of non-buyers, respectively). This is a clear indicator that these companies are more engaged with and more serious about sustainability issues than non-credit-buyers.

2. Voluntary credit buyers are 3x more likely to have science-based sustainability targets in place

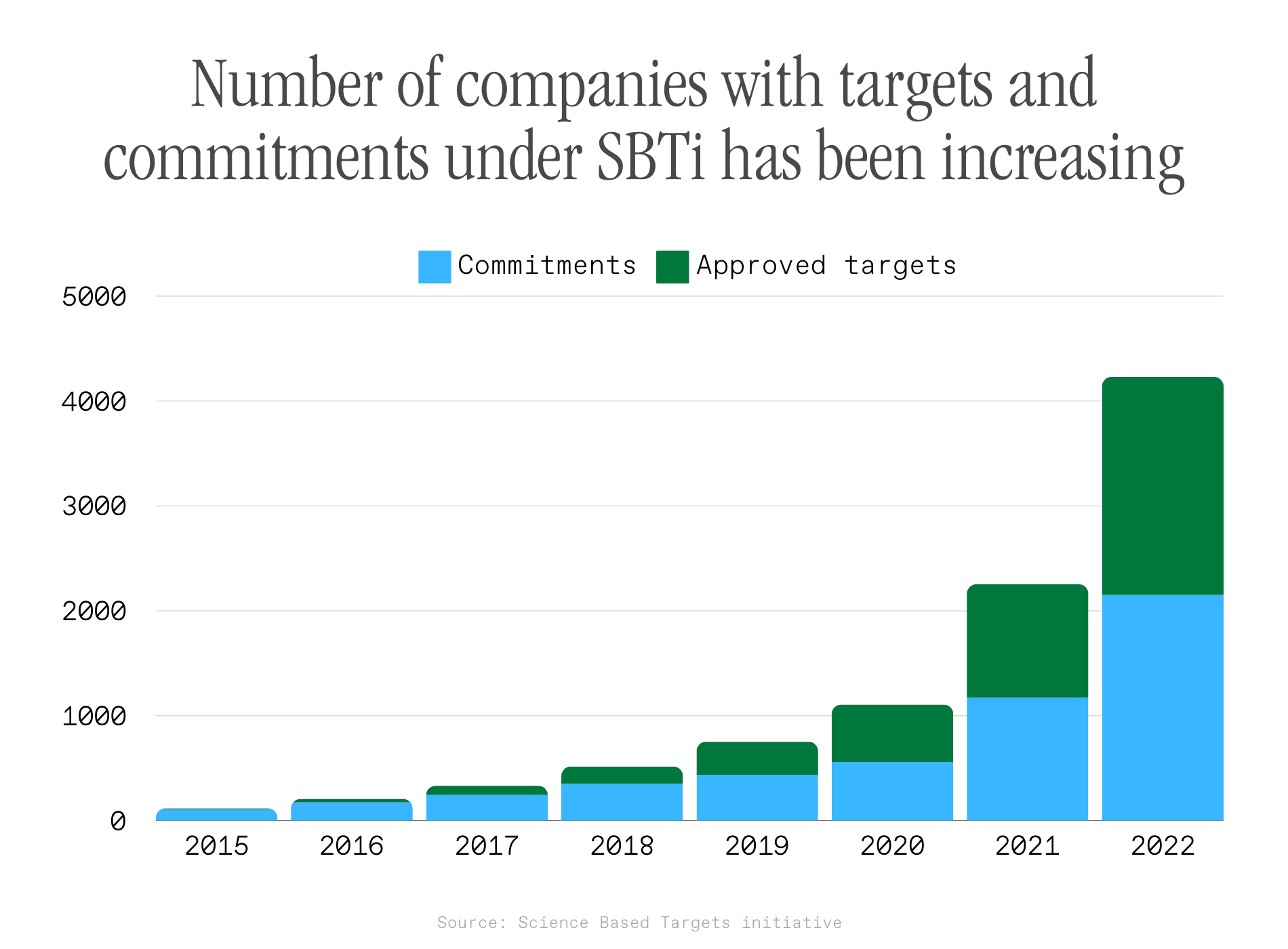

34% of credit buyers have SBTi-approved emissions targets in place, compared to only 10% of non-buyers. Why does this matter?

SBTi stands for Science Based Targets initiative. It is the gold standard in setting sustainability targets, developed through a collaboration of the United Nations Global Compact, the World Wide Fund for Nature (WWF) and other key players.

SBTi guides companies to set greenhouse gas (GHG) emission reduction targets aligned with the level of decarbonization necessary to limit global temperature increase to well below 2°C, preferably to 1.5°C, compared to pre-industrial levels, as outlined in the Paris Agreement.

3. Voluntary carbon buyers are decarbonising their activities at nearly twice the rate of non-buyers

Perhaps the most important of all, Ecosystem Marketplace’s research shows that carbon buyers are actually putting in more effort than non-buyers across a variety of initiatives to reduce their footprint. They are:

- 2.5x as likely to use low-carbon energy sources for their day-to-day operations

- 2x as likely to have set an internal carbon price

- 2x as likely to have increased energy efficiency in their buildings

- 50% more likely to be reducing waste and recycling materials

- and so on

All of which goes to show that rather than rest on their laurels and consider the job done by buying carbon credits, these companies are making significant progress in also reducing their emissions.

How do carbon credit purchases vary according to companies' goals?

Having now better understood who carbon credit buyers are, why they buy, and how their behaviour differs from non-buyers, our last question might be: do these differing approaches change which credits buyers want?

We certainly see some trends around three key areas:

- Industry: companies’ credit purchased often align with their industry - for example, more high-tech companies who prize technological innovation are also more likely to buy credits from technology-based carbon project such as direct-air capture. Alternatively, companies with a large land-use footprint may prioritise nature-based credits

- Price: lower-volume purchasers might be more willing to invest in higher-price credits – buyers who don’t need to hit very high overall retirements may have the luxury to pay more per tonne. This enables them to prioritise higher-quality credits over cheaper, low-quality ones (read more about what makes a carbon credit high-quality)

- Location: while historically buyers of carbon credits were location-agnostic (i.e. were equally happy to buy credits from anywhere in the world), increasingly we are seeing buyers start looking for credits generated in the regions where their operating activities take place. For example, we know of a Scandinavian retailer who was willing to pay up to €100/tonne for credits generated in their home country.

In conclusion, carbon buyers vary in both their motivation and their approaches.

Increasingly, sophisticated buyers are using a portfolio approach: that means combining different types of credits, from different geographies and at different price points. This enables buyers to reduce the risks of overreliance on a certain credit type (e.g. REDD+ credits) and enables them to satisfy several motivations at the same time.

- Who were the largest carbon credit buyers in 2023? Which sectors retire the most carbon credits?

- Why do companies buy carbon credits?

- Are companies buying carbon credits to get out of doing any other meaningful sustainability activities?

- 1. Voluntary credit buyers are 1.2x more likely to report their emissions and to have board level oversight of climate targets than non-buyers

- 2. Voluntary credit buyers are 3x more likely to have science-based sustainability targets in place

- 3. Voluntary carbon buyers are decarbonising their activities at nearly twice the rate of non-buyers

- How do carbon credit purchases vary according to companies' goals?