What are REDD+ carbon credits?

In early 2023, The Guardian (along with Die Zeit) published an article that at first sight seems quite negative towards some forest-based carbon credits: “Revealed: more than 90% of rainforest carbon offsets by biggest provider are worthless, analysis shows”.

A lot of commentary that followed summarised the article (and underlying study) as “all carbon offsets are scams”, “modern day indulgences”, or “greenwashing”.

So, should we give up on carbon credits as a whole as a result of this?

No - and here’s why.

What is REDD+?

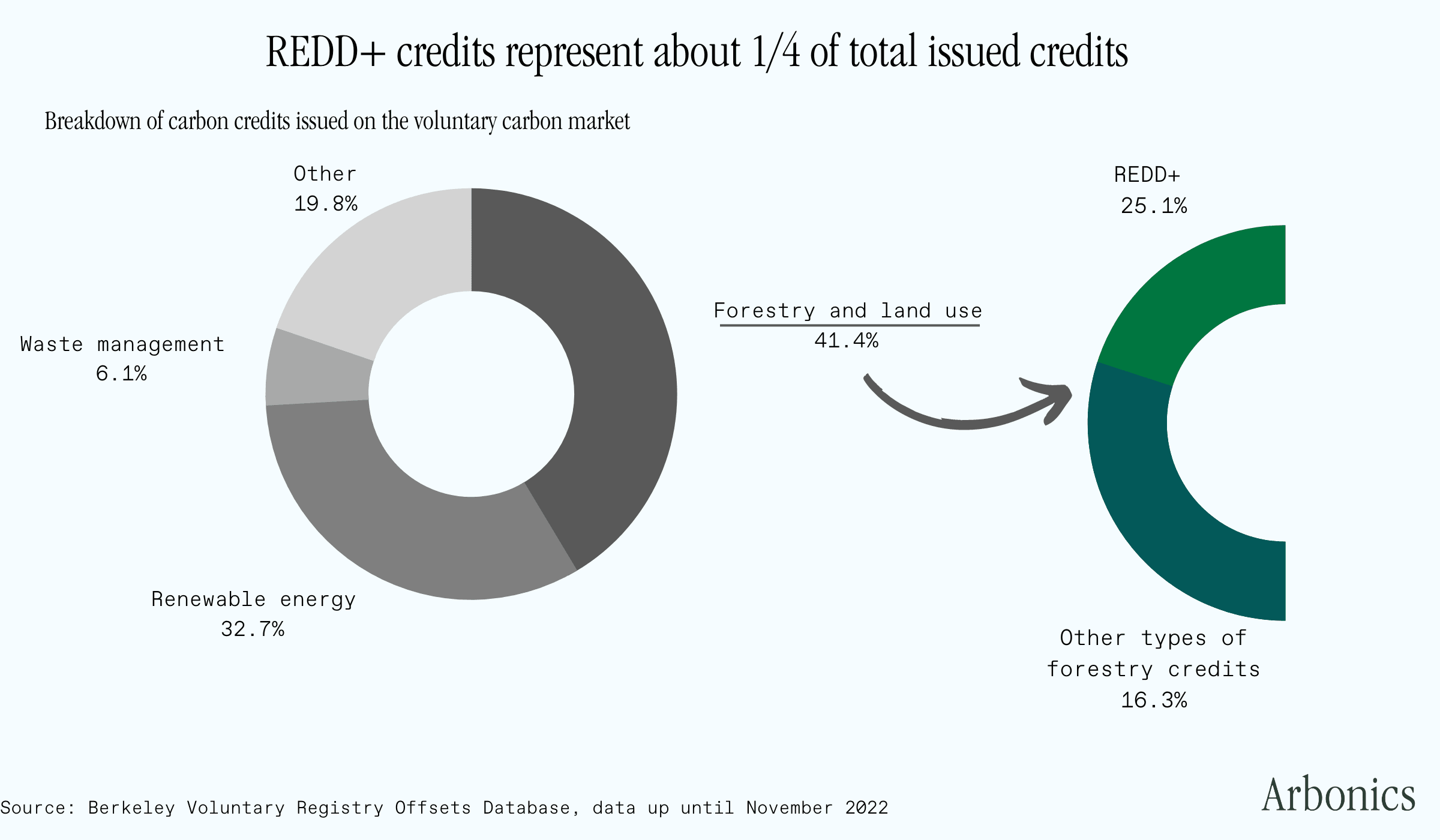

The study referred specifically to REDD+ credits, not all carbon credits. The acronym refers to “reducing emissions from deforestation and forest degradation”. The “+” just means a step up from original REDD credits - REDD+ has more focus on “the role of conservation sustainable management of forests and enhancement of forest carbon stocks in developing countries”.

That’s a lot of words which may not mean much to you. To simplify, REDD+ credits are usually generated in the following way:

- Landowner who owns tropical forests that are not currently protected expresses a desire to earn carbon credits

- They make a solemn promise to not cut their forest

- Profit

I’m simplifying, of course - but not excessively.

REDD+ credits have been criticised within the carbon industry for years - for lack of permanence, lack of additionality, and risk of leakage (i.e. deforestation simply moves to other nearby locations).

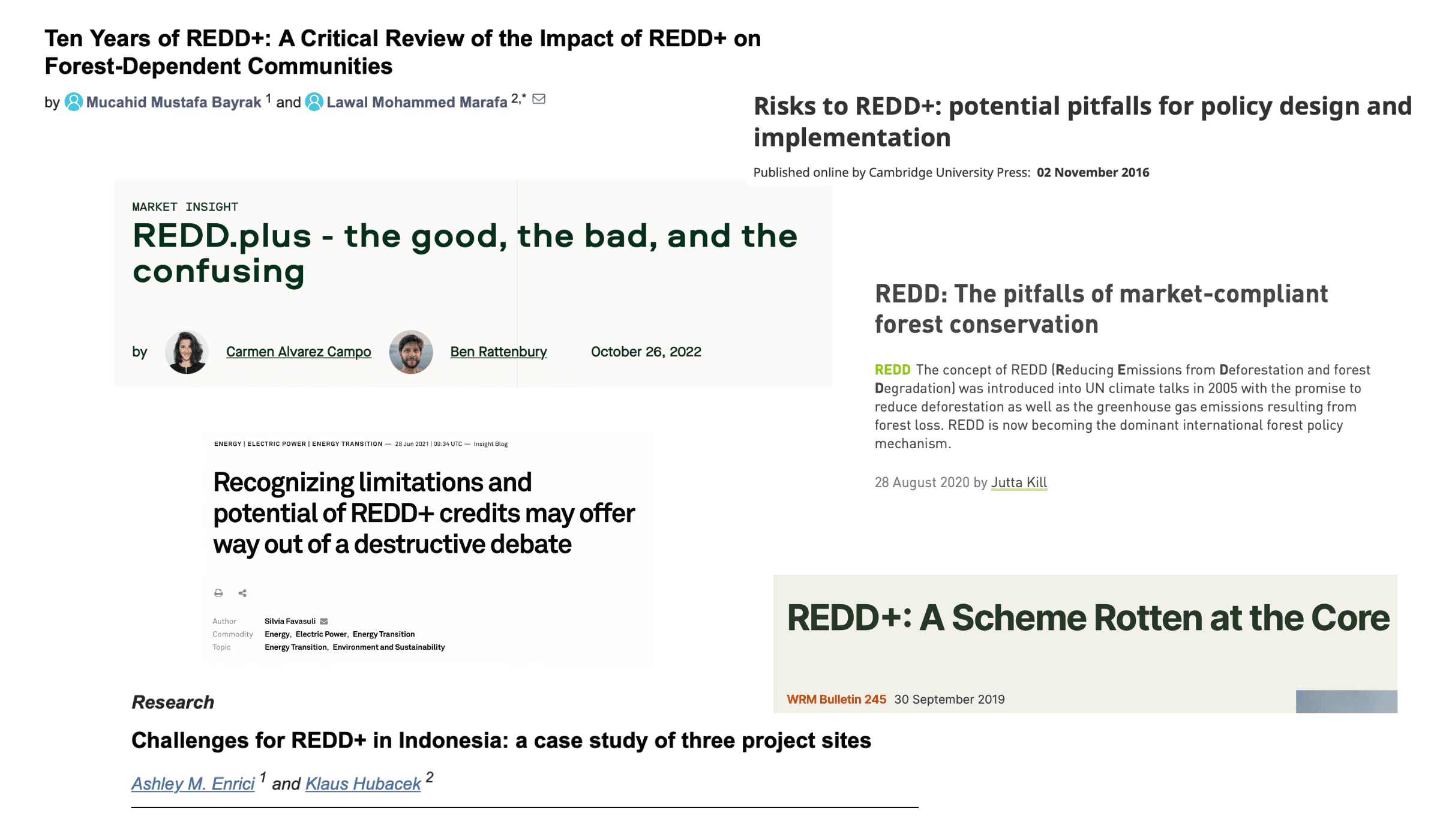

Here’s a sample of just some headlines over the last 7 years:

In short: questions about REDD+ credits have been swirling for a while; and the industry has been making adjustments in response. So the criticism is not news to anyone working in the carbon/climate space; and many of us have been working on alternatives for a while.

Why are REDD+ credits different from other types of credits?

For starters, let’s break down a key difference in carbon credits: avoidance vs removal credits.

In short:

- Avoidance carbon credit - we pay so that other market participants don’t emit CO2. Includes things like avoided deforestation, but also clean cookstove projects, renewable energy projects etc.

- Removal carbon credit - we pay to actually take CO2 out of the atmosphere. Includes afforestation, direct air capture, kelp farming, etc.

(You can read more about carbon credits and their different types here.)

Removal credits are more valuable purely from the planetary CO2 balance perspective, because they actually take away some CO2 from the air.

This is the main reason we should not lump all carbon credits in the same bucket and assume that (valid) criticisms of REDD+ credits apply to all credits - removal and avoidance credits are fundamentally different.

Why do avoidance credits possibly have lower than estimated impact (or no impact at all)?

By definition, avoidance credits deal with “what-ifs”. The core assumption is that if the carbon project didn’t happen, a worse scenario (=more CO2 emitted) would have played out.

In REDD+, this alternative scenario is formulated as an assumption around deforestation rates. For example, the assumption is made in a certain country that all else equal, deforestation might equal 800,000 hectares per year. These projects then protect some amount of land, reducing the theoretical risk of deforestation by the amount of land included in the project.

One of the studies quoted by The Guardian found that the studies had overestimated this deforestation risk - hence that reality was actually better than what the carbon project proponents had assumed. As a result, the impact of their projects was overstated.

Was this due to deliberate falsehoods? Or that simply, the projected “what-if” scenario played out differently than expected? We can never know for sure, because we can’t run a controlled study and analyse multiple timelines in parallel.

However, we do know that high levels of deforestation occur in areas with REDD+ projects, and at least some of these projects are likely to actually protect forests - for example, see a case study by Sylvera here).

This difficulty applies to almost all avoidance credits - we can never know for sure what would have happened in an alternate timeline.

So… you’re saying REDD+ credits are bad, everything else is good?

No, I’m not.

Unfortunately, there are few simple yes/no answers in carbon. It is difficult to lump carbon credits into “good/bad” categories at the methodology level, as there are so many varied aspects of how these methodologies are applied.

(A methodology is a specific rule set for a type of carbon project - e.g. REDD+ has a few methodologies, afforestation has a couple, soil carbon has several. These are available on Verra and other standards’ websites.)

In order for a carbon credit to actually have positive impact, it must pass a few key quality thresholds (as also recently articulated by the EU in their proposed framework for carbon removals):

- Additionality

- Permanence/long duration (you can read more about this concept here)

- Accurate quantification & measurement

- No collateral damage to ecosystems or communities

Many types of carbon credits currently available on the market fail these quality tests. That is a sad fact.

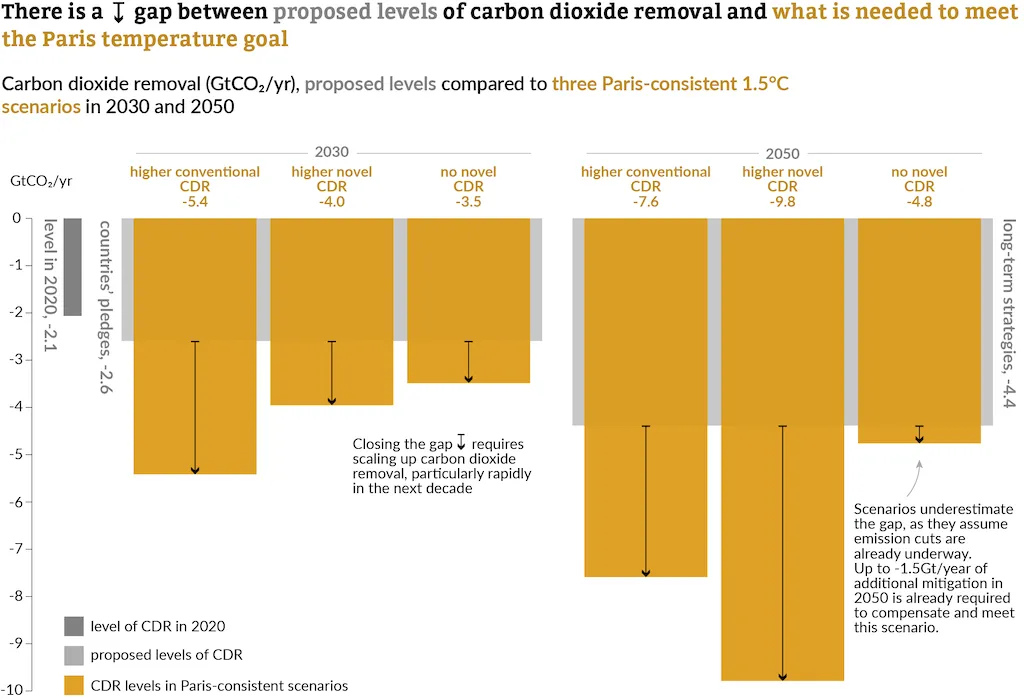

However, the answer is not to get rid of the carbon market entirely. While flawed, it is the only framework we currently have to drive down the gap between feasible emissions reductions and the CO2 levels we want to maintain. Hence, rather than dismissing it, we should be working to improve it.

(The 2nd edition of the State of Carbon Dioxide Removal report highlights the big gap between the need for traditional carbon removal methods, like afforestation, to hit the 1.5°C target, and what’s actually being proposed by national plans).

In the short to medium term, the conversion of the global economy (currently emitting just under 50 gigatonnes of CO2 annually) to a Net-Zero economy will still require unavoidable emissions - generated, for example, even by “green” activities such as manufacturing solar panels or electric cars.

This is where the voluntary carbon market has its place - and where it can be a part of the solution.

What can we do to avoid “fake” carbon credits and use the voluntary carbon market for good, not ill?

In conclusion, we must apply more stringent quality measures to voluntary carbon markets, and expect more from all market participants. This means that we should:

- Question and avoid any low-cost “carbon offsets” often provided to consumers - $5 per tonne of CO2 is almost guaranteed to do absolutely nothing

- Work to understand the differences between different types of credits, and engage with only high-quality ones

- Refer to the work by independent carbon research/rating agencies such as Sylvera and CarbonPlan for up-to-date assessments of carbon methodologies and projects

- Support the creation of new technologies and solutions for carbon storage - such as new types of direct air capture, or trees that store more carbon, or ocean-based CO2 capture etc

If you have any reactions, feedback, or counterarguments, please reach out - I’d love to hear your views.

P.S. While many critiques of REDD+ projects are very valid, deforestation is still a huge issue in tropical regions. While we should always be working on newer, better ways to protect forests, even an imperfect solution is better than nothing, and REDD+ may well have a role to play yet.

That said, significant progress has been made to improve REDD+ projects, with advancements in methodologies, the use of dynamic baselines, and better monitoring techniques.

- What is REDD+?

- Why are REDD+ credits different from other types of credits?

- Why do avoidance credits possibly have lower than estimated impact (or no impact at all)?

- So… you’re saying REDD+ credits are bad, everything else is good?

- What can we do to avoid “fake” carbon credits and use the voluntary carbon market for good, not ill?